Nassau County Surrogate Court serves as the official probate court for estate and inheritance matters in Nassau County, New York. It manages legal processes after a person’s death, including will validation, estate settlement, and court supervision of asset transfer. This court plays a central role in confirming that property passes lawfully and that debts and taxes are addressed before heirs receive assets. The surrogate court nassau county ny operates under the New York Unified Court System and holds countywide authority over probate filings. Residents often interact with this court after the death of a property owner or family member. The Nassau probate court also appoints executors named in wills and selects administrators when no will exists. Through court review, estates follow state law and court orders. As a result, the estate court in Nassau County helps limit disputes and promotes orderly estate settlement. Many cases involve real estate, financial accounts, or personal property located within the county.

Nassau County Surrogate Court handles several case types that differ from other New York courts. Its focus remains limited to estates, trusts, and guardianships, rather than criminal or family matters. This separation allows the court to apply probate-specific rules and procedures. Probate matters become necessary when assets lack beneficiary designations or remain solely in the deceased person’s name. The Surrogate’s Court Nassau also hears contested cases, such as challenges to a will’s validity or disputes between heirs. In estates without a will, the court applies New York intestacy law to decide asset distribution. Guardianship cases involve appointing legal caretakers for minors or adults unable to manage personal or financial affairs.

What Is Probate in Nassau County?

Probate in Nassau County Court is the legal process used to confirm a will and manage estate settlement after a person’s death. The probate court Nassau oversees this process to confirm assets pass lawfully under New York law. Probate plays a key role whenever property remains in the deceased person’s name alone. Through court review, estates move forward with structure, oversight, and legal authority.

Definition of Probate in Nassau County

Probate refers to a court-supervised estate settlement handled by the Nassau County Surrogate Court. The process begins after a death and focuses on validating a will, appointing an executor, and authorizing asset distribution. If a valid will exists, the court confirms its authenticity and grants legal authority to the named executor. If no will exists, the court applies New York intestacy law and appoints an administrator. This ensures estate property transfers to lawful heirs in a set order. The estate probate process also includes identifying assets, notifying creditors, paying debts, and filing required tax documents. Each step requires court approval or filing, which helps maintain accuracy and accountability. Public court records also document estate activity, which supports transparency for heirs and creditors involved in the matter.

When Probate Is Required in Nassau County

Probate becomes necessary when assets remain solely in the deceased person’s name. Real estate located in Nassau County often triggers probate if no joint owner or trust exists. Bank accounts without named beneficiaries usually fall into this category as well. The probate court Nassau also steps in when disputes arise. Challenges related to validating a will, executor conduct, or asset ownership often require formal court review. Estates with outstanding debts or unclear ownership also move through probate. Smaller estates may qualify for simplified procedures under New York law, yet court involvement still applies in many cases.

Probate vs Non-Probate Assets

Not all property passes through probate in Nassau County. Some assets transfer directly by contract or ownership structure. Non-probate assets transfer outside court involvement. Probate assets require court approval before distribution, which places them under court supervision until settlement closes.

Common probate assets include:

- Solely owned real estate

- Personal property without transfer documents

- Bank accounts without beneficiaries

Common non-probate assets include:

- Jointly owned property with survivorship rights

- Life insurance with named beneficiaries

- Retirement accounts with payable-on-death designations

How Nassau Probate Differs From Other NY Counties

Probate in Nassau County reflects local procedures and filing practices set by the Surrogate Court. Filing volume remains high due to population density and property values. As a result, processing timelines may differ from smaller New York counties. Nassau estates often involve real estate, which adds steps such as property valuation and transfer approvals. Court scheduling, document review, and hearing availability may vary based on caseload. The estate probate process still follows statewide law, yet local court rules shape filing formats, scheduling, and administrative review. These local practices influence how quickly estates progress through the system. Probate in Nassau County blends New York law with county-level court oversight to support lawful and organized estate settlement.

How to Search Probate & Estate Cases in Nassau County

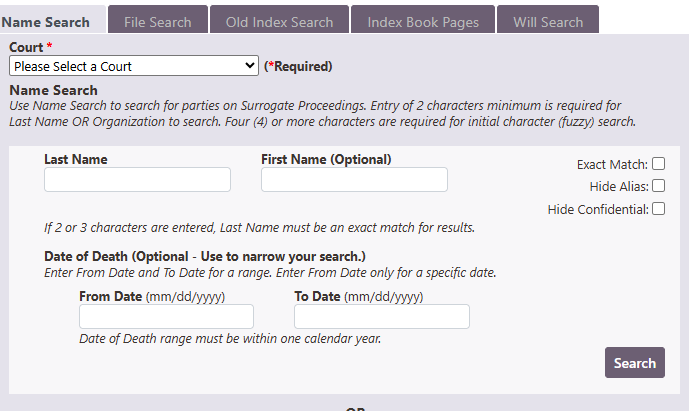

Nassau county probate case search allows the public to review estate and probate filings handled by the Surrogate’s Court. A Nassau county surrogate court case lookup helps locate estate records using a case number, decedent name, or filing year through official court systems Most probate records are searchable through WebSurrogate, the official online system provided by the New York State Unified Court System.

Official Probate Search Portal (WebSurrogate):

https://websurrogates.nycourts.gov/Home/AuthenticatePage

Search by Case Number

A case number search delivers the most accurate results. Each probate filing receives a unique docket or file number at the time of submission. This number appears on court notices, executor papers, and estate correspondence. This method avoids duplicate results and reduces search errors.

How to search:

- Open the official WebSurrogate portal

- Select File Search

- Enter the full docket or file number

- Submit to view estate history and filings

Best use cases:

- Executors tracking estate progress

- Attorneys reviewing filings

- Title and property verification

Search by Decedent Name

A name-based estate case search works well when a file number is unavailable. Records usually list estates under the deceased person’s legal name or as “Estate of [Name].” Avoid punctuation or abbreviations during the first search attempt. Name variations often improve visibility in large probate databases.

Search tips:

- Start with last name only

- Try alternate spellings

- Remove middle names if results appear limited

Search by Filing Year

A probate year filter helps narrow results in high-volume counties like Nassau. This option works well for historical estate records or property research.

Key points:

- Recent probate cases appear more consistently online

- Older estates may show limited digital details

- Some archived files require courthouse review

Online Search vs Clerk-Assisted Search

Online court search through WebSurrogate allows:

- Case summaries

- Filing dates

- Docket numbers

- Limited document visibility

Clerk-assisted search applies when:

- Records predate online systems

- Certified copies are required

- Files fall under restricted court rules

Probate Process in Nassau County

The Nassau county probate process follows a court-supervised sequence used to settle estates after death. These steps guide estate settlement, define executor responsibilities, and shape the probate timeline Nassau County estates commonly follow. Each stage requires court filings, deadlines, and review to move an estate from opening to final discharge.

Filing the Probate Petition

The process begins with filing a probate petition in the Nassau County Surrogate Court. This petition opens the estate case and requests court authority to proceed. The person filing is usually the executor named in the will or a close family member if no will exists. The petition includes basic details such as the decedent’s name, date of death, residence, and a list of heirs. Filing fees apply and vary by estate value. Once accepted, the court assigns a docket number, which becomes the official estate reference. This filing sets the legal foundation for all future estate actions.

Will Submission and Validation

If a will exists, it must be submitted to the court for review. The court examines whether the document meets legal standards, including proper signing and witnessing. This stage is often called testamentary review. Witness affidavits and supporting documents help confirm authenticity. If objections arise, the court schedules hearings to address concerns raised by heirs or interested parties. If approved, the will becomes the controlling document for estate settlement. When no will exists, the estate proceeds under intestacy law instead.

Appointment of Executor or Administrator

After review, the court appoints an executor or administrator. Executors receive authority through Letters Testamentary. Administrators receive Letters of Administration. This appointment grants legal power to act on behalf of the estate. Executor responsibilities include managing assets, opening estate bank accounts, and communicating with beneficiaries. The court defines this authority through formal orders. Without court appointment, no one may lawfully manage or distribute estate property.

Notice to Heirs and Creditors

Next, notice must be given to heirs and known creditors. Heirs receive formal notice of the probate proceeding. Creditors receive notice through direct contact or public publication, depending on the situation. This step allows interested parties to raise claims or objections within set timeframes. Claim deadlines help bring closure to outstanding financial matters tied to the estate. Clear notice reduces later disputes and supports orderly progression of the case.

Asset Inventory and Valuation

The executor prepares a detailed inventory of estate assets. This includes real estate, bank accounts, investments, and personal property. Each asset receives a valuation based on fair market value at the date of death. This inventory is filed with the court and becomes part of the public record. Accurate reporting supports tax filings and fair distribution. Appraisals may apply for property or valuable items. The estate cannot move forward without a complete asset listing.

Debt and Tax Settlement

Before heirs receive property, debts and taxes must be addressed. The executor pays valid creditor claims using estate funds. Final income tax returns and any estate tax filings follow applicable rules. Court review confirms proper handling of payments. If assets must be sold to cover obligations, court approval may apply. This stage often affects the overall probate timeline Nassau County estates experience. Debt settlement protects heirs from later claims tied to the estate.

Distribution of the Estate

Once debts and taxes are resolved, remaining assets may be distributed. Distribution follows the will’s terms or intestacy law if no will exists. The executor prepares a final accounting that details all estate activity. Beneficiaries review this accounting before receiving assets. Transfers may include property deeds, financial accounts, or personal items. Court approval often precedes final distribution. This step marks the transition from estate management to closure.

Court Discharge and Estate Closing

The final stage involves court discharge of the executor or administrator. The court reviews the final accounting and confirms all duties were completed properly. After approval, the court issues an order closing the estate. This release ends executor authority and concludes the probate case. Records remain on file as part of public probate history. The Nassau county probate process follows this structured path to support lawful, documented estate settlement from start to finish.

Relationship Between Family Court and Surrogate Court

Family Court and Surrogate Court both serve distinct but connected functions within the Nassau County Court system by addressing legal matters that arise at different points in family life. Family Court handles issues involving living family relationships, including child custody, support, guardianship, and family protection matters. Surrogate Court addresses related legal responsibilities after a death, such as estate administration, wills, inheritance, and guardianship of property. In Nassau County, Family Court decisions involving paternity, marriage, divorce, adoption, or guardianship often influence Surrogate Court proceedings by establishing legal family status and inheritance rights. Together, these courts provide a continuous legal framework that supports families before and after major life events.

Types of Cases Handled by Nassau County Surrogate Court

The Nassau County Surrogate Court handles legal matters connected to probate, estate administration, wills, and guardianship. This court focuses on estates, trusts, and fiduciary responsibilities after a person’s death or during legal incapacity. Each case type follows specific procedures set by New York law, with court oversight used to confirm lawful outcomes and protect interested parties.

Probate of Wills

Probate of wills forms one of the most common case types before the court. Probate begins after a will is filed following a death. The court reviews the document to confirm it meets legal requirements, a process often called will validation or testamentary proceedings. During probate, the court reviews witness affidavits and confirms the decedent’s intent. If approved, the court issues legal authority to the executor named in the will. This authority allows the executor to gather assets, pay debts, and prepare the estate for distribution. Probate also creates a formal record of the will and estate activity. If objections arise, such as claims of undue influence or lack of capacity, the court schedules hearings to resolve those disputes. Probate oversight helps reduce improper transfers and supports fair distribution under state law.

Estate Administration

Estate administration applies when a person dies without a valid will. These cases are known as intestate estates. In such matters, the Surrogate Court appoints an administrator to manage the estate. The administrator appointment follows a priority order set by New York law, usually favoring close family members. Once appointed, the administrator carries duties similar to an executor. These duties include identifying assets, notifying creditors, paying lawful debts, and distributing property to heirs. Distribution follows intestacy statutes rather than personal wishes. The court supervises each step to confirm compliance with legal standards. Estate administration cases often involve family disputes, property transfers, or unclear ownership records, making court supervision central to orderly resolution.

Guardianship Proceedings

Guardianship proceedings protect minors and adults who cannot manage personal or financial affairs. The Surrogate Court handles guardianship of minors who receive inheritance or settlement funds. It also oversees cases involving incapacitated persons with estate interests. In these cases, the court reviews medical reports, financial details, and proposed care plans. A guardian receives limited authority defined by court order. The guardian must report actions to the court on a regular schedule. This process places strong emphasis on asset protection and personal welfare. Guardianship oversight helps prevent misuse of funds and supports long-term care needs. Court review continues until the guardianship ends or authority changes.

Trust & Fiduciary Matters

Trust and fiduciary matters involve court supervision of trustees, executors, and administrators. These cases focus on fiduciary duties such as loyalty, transparency, and proper asset management. The court reviews trust accountings, resolves disputes between beneficiaries, and addresses claims of mismanagement. Trust oversight applies to both living trusts and testamentary trusts created through a will. Fiduciary proceedings may include removal of a trustee, approval of distributions, or guidance on trust interpretation. Court involvement helps protect beneficiaries and supports lawful administration of trust property.

Required Forms & Documents for Nassau Surrogate Court

Nassau county surrogate court forms are required to open, manage, and close probate and estate cases. These documents allow the court to review filings, issue authority, and record estate activity under New York law. Proper paperwork supports accurate case handling and keeps estate matters moving through the court system without delay.

Common Probate Petitions

Every probate case starts with a formal petition filed with the Surrogate Court. This document requests court authority to begin estate proceedings. The petition lists the decedent’s details, known heirs, and estimated estate value. Probate filing documents differ based on whether a will exists. A probate petition applies when a will is present. An administration petition applies when no will exists. Both filings require a certified death certificate and supporting schedules.

Common petition attachments include:

- Certified death certificate

- Family tree or heirship affidavit

- Asset summary page

- Original will, if available

Letters Testamentary

Letters Testamentary serve as official proof of executor authority. The court issues these documents after will review and approval. Executors use them to manage estate assets, open estate accounts, and complete property transfers. Financial institutions often request certified copies before releasing funds. Real estate transfers also rely on these letters to confirm legal authority. Executors must keep copies available throughout estate settlement. This document remains valid until the estate closes or the court limits authority.

Letters of Administration

Letters of Administration apply to estates without a will. These papers confirm the court-appointed administrator’s authority to act on behalf of the estate. The administrator appointment follows a priority list under New York law. Once issued, these letters allow asset collection, debt payment, and distribution to lawful heirs. Administrator authority mirrors executor authority in most cases. Court supervision continues through regular filings and final accounting.

Filing Fees Overview

Filing fees depend on estate value. Nassau Surrogate Court follows a graduated fee schedule set by New York law. Smaller estates carry lower fees. Larger estates require higher filing payments.

Typical fee ranges include:

- Small estates: lower fixed filing fee

- Mid-size estates: moderate filing fee

- High-value estates: higher statutory fee

Where to Get Official Forms

Official estate court forms come from the New York State Unified Court System. These forms follow court standards and reduce filing errors.

Forms are available:

- Through the NY Unified Court System website

- At the Nassau County Surrogate Court clerk’s office

- Via official court form libraries

Filing Probate in Nassau County: Online vs In-Person

To file probate Nassau County, estates may submit documents through electronic filing systems or deliver paperwork directly to the Surrogate Court. Each filing option follows court rules and fits different estate types, document requirements, and timelines. Selecting the correct filing method helps limit delays, reduces rejected submissions, and supports smoother court review.

E-Filing Eligibility in Nassau County

Electronic court filing NY systems allow probate filings for many Nassau County estates. This option mainly applies to attorneys and registered users through the NYSCEF platform. Some uncontested probate matters qualify for electronic submission. E-filing allows petitions, affidavits, and supporting documents to be submitted through an online portal. Documents receive instant timestamps, which helps with deadline tracking. Filing fees are paid electronically during submission. Certain estates remain outside e-filing eligibility. These include restricted filings, older case categories, or matters requiring original documents. In many cases, original wills must still be delivered physically to the court, even when other paperwork is submitted online.

Clerk Office Role in Probate Filing

The Surrogate Court clerk’s office manages probate intake and case processing. Clerks review filings for completeness, formatting accuracy, and required attachments. Once accepted, clerks assign docket numbers and issue notices for corrections if needed. In-person court filing occurs at the Nassau County Surrogate Court clerk window. This method suits self-represented filers, estates involving original documents, or cases with court-specific instructions. Clerks handle document intake, fee collection, and record maintenance. They do not provide legal direction. Well-prepared filings move through clerk review more efficiently.

Processing Timelines for Probate Filings

Processing timelines depend on filing method, estate size, and court workload. E-filed submissions typically enter the system faster, though judicial review time varies. Straightforward probate matters may receive initial review within several weeks. In-person filings may take longer during periods of high volume. Missing documents or filing errors often extend timelines. Contested estates usually require hearings, which lengthen the probate timeline Nassau County estates follow. Court notices and approvals progress steadily once filings meet all requirements.

Common Probate Filing Mistakes

Many probate delays result from avoidable filing errors. Submitting outdated forms or incomplete paperwork remains a frequent issue. Careful review before submission supports faster processing and reduces court notices. Filing probate Nassau County cases through the correct method supports efficient court handling and consistent estate progress.

Common filing mistakes include:

- Missing certified death certificates

- Incomplete heir or beneficiary details

- Incorrect filing fees

- Unsigned petitions or affidavits

Roles & Responsibilities Explained

The Nassau County Surrogate Court assigns formal roles to manage estates and protected interests. Executor duties Nassau County, the estate administrator role, and guardian authority all carry fiduciary obligations and defined legal responsibilities set by New York law. Each role comes with court-granted authority, mandatory reporting, and personal liability risks if duties are ignored or mishandled.

Executor: Authority and Core Duties

An executor is named in a valid will and receives authority after court approval. That authority is issued through Letters Testamentary, which permit the executor to act for the estate. Executor duties Nassau County estates require include securing property, collecting assets, and managing estate funds. Executors must follow the terms of the will and court orders. They handle creditor claims, arrange payment of valid debts, and coordinate required tax filings. Asset distribution takes place only after court approval and completion of estate obligations. This role carries fiduciary obligations. Executors must act in good faith, avoid conflicts of interest, and protect estate value. Poor recordkeeping, delayed action, or improper transfers may expose the executor to personal financial responsibility.

Administrator: Estate Management Without a Will

The estate administrator role applies when a person dies without a valid will. The Surrogate Court appoints an administrator based on a statutory priority order, often beginning with close relatives. Once appointed, the administrator receives Letters of Administration. These letters grant authority similar to that of an executor. The administrator collects estate assets, notifies creditors, pays approved claims, and prepares the estate for distribution. Distribution follows New York intestacy law rather than personal instructions. Court supervision remains active throughout the case. Administrators who misuse funds, miss deadlines, or fail to follow court direction may face removal or liability for losses.

Guardian: Protection of Minors and Incapacitated Persons

Guardians are appointed to protect minors or adults unable to manage personal or financial affairs. In Surrogate Court matters, guardianship often relates to inherited assets or settlement funds. Guardian authority is limited by court order. Some guardians manage finances only, while others oversee personal care decisions. Regular reporting is required, including financial accountings and status updates. Guardians must act solely in the protected person’s interest. Use of funds outside approved purposes may trigger court action and repayment responsibility.

Reporting Requirements and Personal Liability Risks

All fiduciary roles require ongoing reporting to the court. Inventories, accountings, and sworn statements document estate activity and financial handling.

Common liability risks include:

- Missing required filings

- Improper asset use

- Incomplete financial records

- Self-dealing or conflicts of interest

How Long Does Probate Take in Nassau County?

The probate timeline Nassau County estates follow varies based on estate details and court activity. Some estates close within months, while others remain open for years due to legal or procedural delays. Probate duration depends on multiple factors tied to estate structure, court review, and participation of heirs and creditors.

Typical Probate Duration in Nassau County

For a straightforward estate with a valid will, probate often takes 6 to 12 months. These cases involve limited assets, no disputes, and complete paperwork submitted on time. The court reviews filings, issues authority, and allows estate settlement to move forward steadily. More involved estates may take 18 months or longer. Large asset values, real estate transfers, or tax filings add steps to the estate settlement timeframe. Each added requirement extends review and approval periods.

Impact of Estate Size and Complexity

Estate size plays a major role in probate duration. Smaller estates with clear asset ownership move faster through court review. Larger estates require detailed inventories, appraisals, and accountings. often face longer timelines due to valuation and reporting needs. Asset sales may also require court approval, which adds time.

Estates that include:

- Multiple properties

- Business interests

- Investment portfolios

Effect of Disputes and Objections

Disputes significantly extend the probate timeline Nassau County courts manage. Will contests, claims of undue influence, or disagreements among heirs often require hearings and legal review. Once objections are filed, the court must schedule conferences or hearings. Each appearance adds weeks or months to the process. Settlement discussions may resolve disputes, though contested cases often remain open much longer than uncontested estates.

Court Backlog and Scheduling Delays

Court workload affects probate duration. Nassau County handles a high volume of estate cases each year. Review timelines depend on staffing, judicial availability, and filing volume. During peak periods, even complete filings may wait weeks for review. Hearing availability also affects scheduling, especially for contested matters or accounting approvals.

Missing or Unknown Heirs

Missing heirs create additional delays. The court may require searches, affidavits, or public notices to confirm heir status. These steps protect lawful distribution but extend timelines. Estates cannot close until all heirs are identified or legally addressed. This requirement often adds months to the estate settlement timeframe.

General Timeline Expectations

Most estates fall within predictable ranges:

- Simple estates: 6–12 months

- Moderate estates: 12–18 months

- Contested or complex estates: 18 months or longer

Location & Contact Info

The Nassau county surrogate court address identifies where probate, estate, and guardianship matters are filed and reviewed in Nassau County, New York. This courthouse serves as the central location for in-person filings, record review, and clerk-assisted services related to estate cases. Knowing the court’s location and how the clerk’s office functions helps filers plan visits and prepare documents correctly.

Physical Court Address

The Nassau County Surrogate Court is located at:

262 Old Country Road

Mineola, NY 11501

This courthouse houses the Surrogate Court clerk’s office, judicial chambers, and public service counters. Visitors should bring valid identification and allow time for security screening upon entry.

Court Office Hours

Court office hours generally follow standard business schedules on weekdays. Most filings, record requests, and clerk interactions take place during daytime hours. Office hours may vary by department or during holidays. Arriving earlier in the day often helps avoid longer wait times, especially during high-volume periods.

Role of the Surrogate Court Clerk

The surrogate court clerk plays a key role in estate case processing. Clerks receive probate petitions, review filings for completeness, collect filing fees, and assign docket numbers. They also maintain court records and manage document requests. Clerks provide procedural information related to filing steps and form requirements. They do not offer legal opinions or case strategy advice. Well-prepared documents help clerks process filings more efficiently.

General Contact Guidance

General contact with the court usually takes place through the clerk’s office. Phone inquiries work best for questions about filing status, record availability, or office procedures. In-person visits support document submission, file review, and certified copy requests.

For smoother interaction:

- Bring complete paperwork

- Know the case or file number, if available

- Confirm office hours before visiting

FAQs About Nassau County Surrogate Court

The Nassau county surrogate court FAQs section answers common probate questions raised by families, executors, and heirs. These responses explain how estate matters move through the court and what to expect during probate-related proceedings.

Is probate mandatory in Nassau County?

Probate is required in many estate situations, though not every estate enters this process. Probate usually applies when assets remain solely in the deceased person’s name and lack beneficiary designations. Real estate, personal property, and financial accounts without joint ownership often require court review. Small estates may qualify for simplified procedures under New York law. Even in those cases, court filing still applies, though steps remain limited. The Surrogate Court determines whether probate applies based on asset type and estate value.

Can probate be avoided?

Some estates avoid probate through proper planning completed before death. Assets that pass directly to beneficiaries do not require probate court review. These assets transfer outside court supervision. Estate planning tools often reduce probate involvement, though court review may still apply for remaining assets.

Common examples include:

- Jointly owned property with survivorship rights

- Retirement accounts with named beneficiaries

- Life insurance policies with valid designations

- Assets held in living trusts

What happens if there is no will?

When no will exists, the estate proceeds through administration rather than probate of a will. The Surrogate Court appoints an administrator based on a priority order defined by New York law. The administrator manages the estate and distributes assets under intestacy statutes. Distribution follows family relationship order rather than personal wishes. Court supervision applies throughout the case to confirm proper handling and lawful distribution. Estate administration cases often involve similar steps as probate, including asset inventory, debt settlement, and final accounting.

Can probate be contested in Nassau County?

Probate may be contested under certain circumstances. Interested parties may challenge a will’s validity or raise objections related to estate handling. Once objections are filed, the court schedules hearings to review evidence. Contested cases often extend the estate settlement timeframe due to added review and court appearances.

Common reasons for contest include:

- Claims of undue influence

- Questions about mental capacity

- Improper execution of the will

- Disputes involving executor conduct

How long does the Surrogate Court process take?

The timeline varies based on estate size, court workload, and dispute presence. Simple estates with complete filings may progress within several months. Larger or contested estates often remain open longer. Court review time also depends on hearing schedules and document accuracy. Missing paperwork or filing errors extend timelines.

Are probate records public?

Many probate records remain public once filed, including case summaries and docket information. Some documents carry restrictions based on privacy rules or case type. Access varies by record age and filing status. The nassau county surrogate court FAQs help clarify how probate functions, what triggers court involvement, and how estates move through the legal process.